Funded Futures Network Trading Plans

Overview of Funded Futures Network Trading Plans

Funded Futures Network offers a variety of futures trading plans designed to suit different trading levels and styles. Each plan provides access to firm capital, allowing traders to focus on strategy without risking personal funds. With diverse plans, traders can select the futures trading business plan that best fits their objectives, risk tolerance, and experience level.

Funded Futures Network Express Plans: Which to Choose?

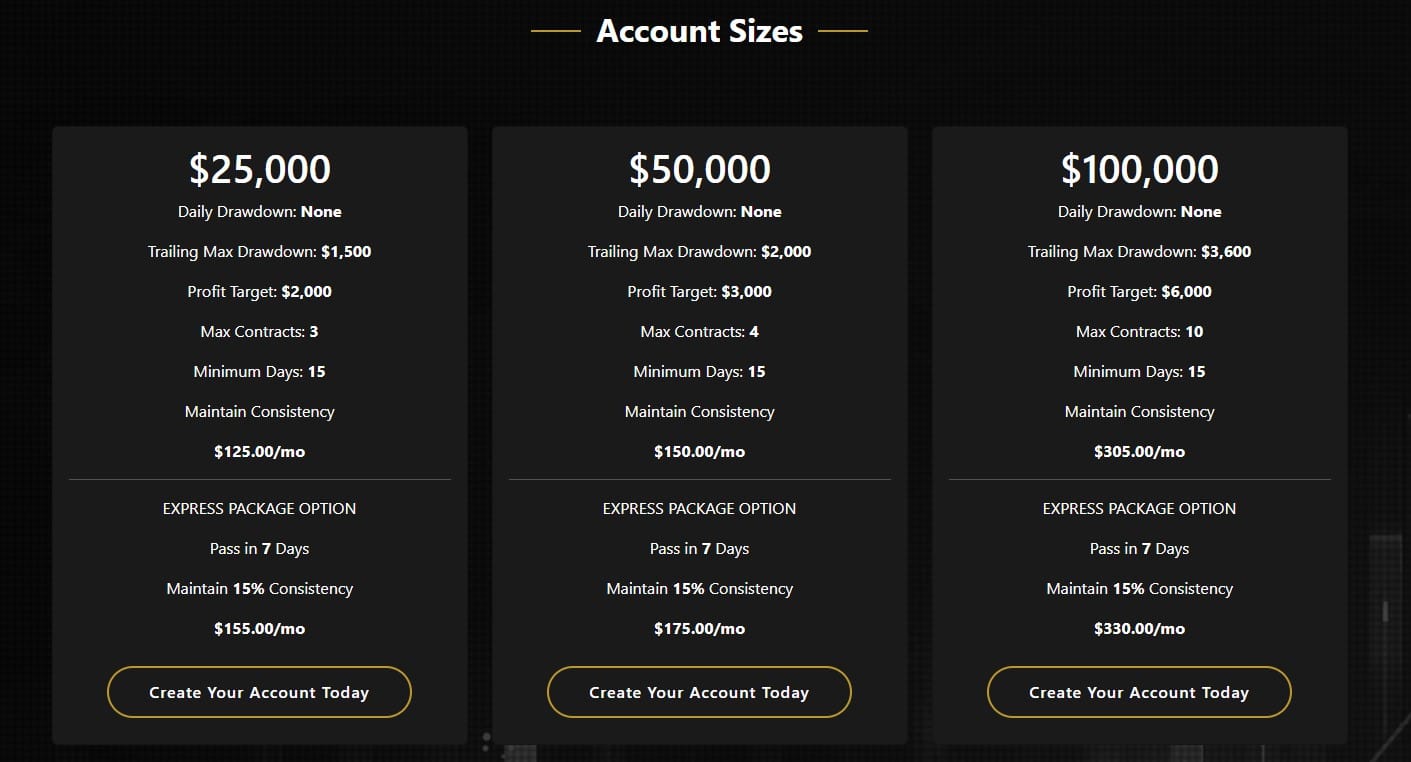

The Express Plans range from $25,000 to $250,000 in starting capital, allowing traders to select a plan that aligns with their financial and trading goals. Each plan comes with unique profit targets and drawdown limits to encourage responsible trading practices. This range enables traders to create a trading plan for futures that matches their specific needs and ambitions.

$25,000 Express Plan

The $25,000 Express Plan is ideal for beginner traders who want to start with lower capital while still experiencing real market conditions. With a smaller initial capital, this plan provides an accessible entry into the world of funded trading and a strong foundation for building a futures trading plan. We recommend trading with micro contracts on this account which are 1/10th the size of a mini contract.

Features of the $25,000 Express Plan

This plan includes a modest profit target and a conservative drawdown limit, making it a manageable starting point for traders with limited experience. The end of trade realized trailing drawdown is $1500. The profit target on this account is only $2000. Make sure you read the rules page of the website to fully understand the rules of the accounts. This account offers full access to the Funded Futures Network's preferred platforms, enabling traders to gain valuable practice with live market conditions while adhering to their futures trading business plan.

$50,000 Express Plan

The $50,000 Express Plan is suitable for intermediate traders seeking a balanced approach between risk and reward. This plan provides more flexibility for larger trades while remaining within achievable drawdown limits. This is one of our most popular trading accounts. This is FFN's most popular account because it has a $2000 end-of-trade realized trailing drawdown, with only a $3000 profit target to pass.

Features of the $50,000 Express Plan

This plan allows for slightly higher profit targets and drawdowns than the $25,000 plan, giving traders room to apply more advanced trading strategies. It’s ideal for those who are looking to expand their trading plan for futures with a manageable increase in capital and responsibility. Keep in mind on all of the express plans, there is a 15% consistency rule that must be followed in order to pass.

$100,000 Express Plan

For traders ready to scale up their trading, the $100,000 Express Plan provides a substantial capital boost. This plan is designed for traders who have developed consistent strategies and want to test them with a more significant balance.

Features of the $100,000 Express Plan

The $100,000 plan offers higher profit targets of $6000 and drawdown limit of $3600, allowing traders to exercise more sophisticated strategies within their futures trading business plan. It is an excellent choice for those aiming to take their trading skills to the next level with ample room to achieve growth. You can start with 4 mini contracts or 40 micros and then scale all the way up to 10 mini contracts as a max, see our contract scaling plan for more details on that.

$150,000 Express Plan

The $150,000 Express Plan is a step up for advanced traders who are comfortable handling larger account sizes and higher profit targets. This plan provides ample room for strategic growth, appealing to traders with substantial experience in futures trading. Lots of traders like this account because if you follow the contract scaling plan you can trade up to 15 mini contracts although most traders stay conservative at 4 contracts. This account has a profit target of $9000 and an end of trade realized trailing drawdown of $5000.

Features of the $150,000 Express Plan

With higher allowable drawdown and profit limits, the $150,000 plan supports experienced traders in executing a more comprehensive futures trading plan. It is suited for those with a proven track record, offering the freedom to scale their positions and further their trading objectives.

$250,000 Express Plan

The $250,000 Express Plan is the ultimate choice for professional-level traders who seek maximum capital and flexibility. It provides the highest profit targets and drawdown limits, ideal for those looking to implement a robust and highly detailed trading plan for futures. This is our largest account with a $6000 end of trade realized trailing drawdown and a profit target of $15,000. You can trade a maximum of 20 contracts when you scale up, and you start with 6 contracts.

Features of the $250,000 Express Plan

This plan grants the most substantial profit target and drawdown allowances, offering professional traders the flexibility to engage in larger trades and strategies. It’s a premium plan for those aiming to maximize their earnings while leveraging Funded Futures’ resources and capital.

Choose the Right Funded Futures Network Plan For You

Selecting the right Funded Futures plan depends on your trading experience, risk tolerance, and financial goals. Consider the amount of capital you’re comfortable managing and the profit targets you’re aiming to achieve. Evaluating each plan’s drawdown limits and profit potential can help you build a futures trading business plan tailored to your needs and ensure a positive trading experience.

FAQs About Funded Futures Network Trading Plans

What is a Funded Futures Network Trading Plan?

A Funded Futures Network trading plan is a structured account that provides traders with firm capital to trade futures markets. It includes guidelines on profit targets, drawdown limits, and other rules to help traders grow their accounts responsibly. The rules at FFN are made to make traders better and more consistent.

How Do I Qualify for a Funded Futures Network Account?

To qualify, traders typically need to meet certain performance metrics, including maintaining drawdown limits and hitting profit targets during a trial period. This evaluation ensures that traders have the skills to handle a funded account.

What Are the Profit Targets and Drawdown Limits?

Profit targets and drawdown limits vary by plan, with higher targets and flexible limits for larger account sizes. These limits help traders stay within the parameters of their trading plan for futures, promoting long-term profitability.

Are There Any Fees for Funded Futures Network Trading Plans?

Funded Futures Network offers competitive fee structures that vary by plan. These fees cover platform access, educational resources, and account maintenance, supporting traders as they progress toward their goals.

Conclusion

Creating a futures trading plan is essential for success in the fast-paced futures market. With Funded Futures Network’s range of Express Plans, traders of all experience levels can find a plan that suits their goals, providing firm capital, support, and structured guidelines. Whether you’re starting with $25,000 or managing $250,000, Funded Futures Network offers the tools and resources to help you excel in funded trading.