Micro Bitcoin Futures Explained For New Traders

Navigating the world of micro bitcoin futures can feel overwhelming, especially for those just starting out. Futures contracts offer traders new ways to participate in the rapidly-changing bitcoin market, but their complexity can intimidate even experienced investors. Fortunately, micro futures now make it easier for beginners to get started with lower risk and capital requirements.

These contracts open the door to bitcoin markets with much smaller account sizes. Instead of feeling pressured to commit thousands upfront, you can learn to manage risk and build your confidence one small trade at a time.

What Are Micro Bitcoin Futures?

These are standardized exchange-traded contracts that allow traders to speculate on the future price of bitcoin, but at a fraction of the size of a regular contract. The CME Group introduced micro bitcoin to make bitcoin futures trading more accessible to new and smaller-scale traders. With a contract size of just 0.1 bitcoin per contract, this represent just one-tenth of a full-size bitcoin futures contract, enabling precise risk control and portfolio management.

What Makes Them Unique

First, their smaller contract size lowers the barrier to entry, allowing more traders to participate without tying up substantial capital. This smaller scale means your gains, and potential losses, are more manageable, especially for those learning the ropes of micro futures trading. Another distinct feature is pricing transparency and standardization, which are hallmarks of reputable futures markets. Compared to unregulated venues or over-the-counter contracts, these micro contracts trade on established exchanges with clearly defined rules and oversight.

Why They’re Perfect for Beginners

Many new traders are intimidated by standard-size bitcoin contracts, with their high margin requirements and large swings in value. Micro bitcoin futures solve this by offering a right-sized alternative that is aligned with smaller accounts. When your contract size is just 0.1 bitcoin, you can calibrate your exposure much more precisely and trade multiple contracts if you want to scale in gradually. This low-risk entry point opens the bitcoin futures market to a wider range of participants, including retail traders and those with limited cryptocurrency experience.

Micro vs Mini Futures: What’s the Difference?

Understanding the distinction between micro vs mini futures is crucial for any trader wanting to pick the right product for their needs. Both micro and mini contracts are smaller-scale versions of standard futures contracts, but their sizes and trading nuances can lead to big differences in how you plan and execute your market strategy.

Contract Size Comparison

Mini futures contracts were originally developed for traders who wanted less exposure than full-size contracts but still needed enough leverage to amplify their gains, or losses. For instance, a standard bitcoin futures contract on the CME represents 5 bitcoins. The mini bitcoin contract, when available, might represent just half or even one-tenth that amount.

Why Micro Bitcoin Are Better for Small Accounts

For traders with limited capital, micro bitcoin contracts are a powerful tool for risk management. The low capital required per contract means you can limit your exposure and still gain firsthand market experience. Micro bitcoin’s smaller tick value and contract size let you scale your trade size to fit your unique risk tolerance. This is important not only for everyday investors but also for professionals looking to hedge or diversify in smaller increments.

How Micro Futures Changed the Game

The arrival of micro futures has significantly shifted the trading landscape, benefiting everyone from retail traders to sophisticated professionals. Micro trading has grown rapidly in popularity, helping reshape how people approach trading not only in crypto but also in commodities, indices, and currencies.

Benefits of Micro Trading

Micro futures trading enables traders with modest resources to compete alongside big institutions. This “democratization” of the market means everyday traders can practice real-time strategies, manage risk with smaller positions, and learn market dynamics firsthand. By enabling trading with smaller position sizes, micro contracts have made diversification simpler and safer. For instance, a trader can now hold multiple micro positions in bitcoin, S&P indices, or gold, rather than concentrating all risk in a single standard contract.

Micro contracts also make it easier to improve your trading psychology. With less money at stake, traders are less likely to make rash decisions based on emotion. In fact, platforms like Traders’ Academy stress the significance of practicing with micro contracts as a key learning step.

How Micro Contracts Make Trading Affordable

Trading micro futures contracts transforms affordability, especially for those on tight budgets. Lower margin requirements mean you can participate in the same price action as larger traders, just at a scale that’s tailored to your account size. As a result, micro trading brings a sense of balance between risk and reward, opening up active trading to thousands who previously would have stayed on the sidelines.

How Micro Bitcoin Fits Into the Bigger Crypto Picture

Micro bitcoin contracts are more than just a new product, they signal the expansion and maturing of the entire crypto futures ecosystem. Understanding their broader market role can help you see opportunities that might not be immediately obvious.

Why Micro Bitcoin Matters in the Market

The introduction of micro bitcoin contracts was a pivotal moment for crypto futures. These approachable contract sizes mean that more traders worldwide can access and trade bitcoin in a regulated environment. Micro bitcoin contracts offer better price discovery, increased trading volume, and tighter spreads compared to larger contracts or spot trading. This supports overall market stability and enhances liquidity for all participants.

Who Should Trade Micro Bitcoin?

Beginners use them to gain real-world crypto trading experience with manageable risk. Experienced traders appreciate the flexibility to hedge larger spot holdings with small increments, run algorithmic trading bots, or refine strategies with minimal drawdowns. Even institutions are embracing micro crypto products to fine-tune exposure and manage portfolio volatility.

Nano Bitcoin Futures vs Micro Bitcoin Futures

Nano bitcoin futures add another layer of accessibility, offering even lower risk and contract value. So how do you decide between the two?

Contract Size and Value Comparison

Nano bitcoin futures are, as the name suggests, even smaller than micros. This is helpful for absolute beginners or those who want to practice with the lowest possible risk. However, it’s important to note that, because trades are so small, transaction costs as a percentage of the total trade can be higher, which may affect long-term profitability.

Which One Fits Your Strategy?

If you want the smallest possible contract to limit exposure, nano futures could be your best starting point. For most aspiring traders, though, micro futures contracts provide practical trade sizing, reasonable transaction costs, and access to robust exchange infrastructure.

Micro bitcoin contracts let you engage the market with flexibility and offer a smoother learning curve as you develop skills and confidence. If your focus is on learning how to trade micro futures while building a foundation for future larger positions, micro contracts usually provide the best balance.

The Basics of Micro Futures Trading

While bitcoin futures are a revolutionary addition to crypto markets, the concept of micro futures extends beyond digital currencies. Understanding how these small contracts work in traditional markets can improve your skills across different asset classes.

Micro Futures Beyond Crypto

Micro futures contracts can be found on everything from the S&P 500 to gold, oil, and currencies. They serve a similar purpose as in the crypto world: to make trading more accessible through lower margin and contract size. For example, micro E-mini futures cover indices like the S&P 500 and NASDAQ, offering fraction-sized contracts compared to standard E-mini products. This allows traders with any account size to participate in diverse markets and practice risk management across sectors.

Learning From Traditional Futures Markets

The mechanics of micro futures contracts are rooted in established futures market principles. Key concepts, such as leverage, margin requirements, and tick values, apply in every micro contract, whether you’re trading bitcoin or oil. Studying how traditional markets operate can give you an edge when transitioning to crypto futures.

How to Trade Micro Futures the Right Way

Getting started with bitcoin futures means following a straightforward process focused on discipline, learning, and accountability. If you want to trade bitcoin futures efficiently and effectively, there are some key steps you can’t skip.

Step 1: Choose a Reliable Broker

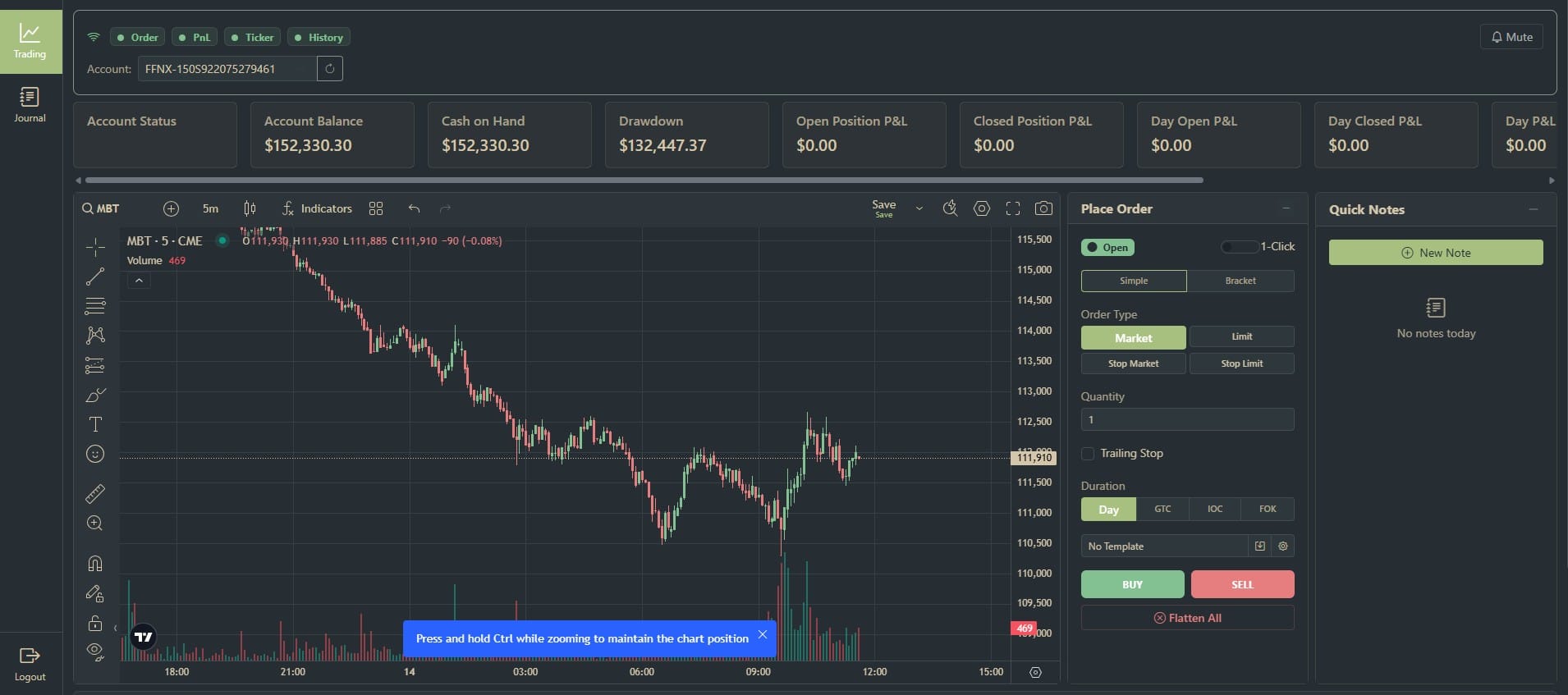

Some brokers specialize in micro futures trading, providing tailored technology and risk controls for retail traders. It’s important to compare platforms based on available markets, fees, risk management tools, and educational support.

Many of today’s top brokers offer demo trading accounts, which allow you to practice trading micro bitcoin or other micro contracts without putting real money at risk. Look for platforms that offer reliable access to the CME and support robust risk management features.

Step 2: Fund and Manage Your Account

Once you’ve chosen a broker, funding your account comes next. Micro bitcoin’s smaller margin requirements let you start with less capital, but it’s still important to only fund your account with money you can afford to lose. Proper account management means tracking available margin, setting stop-loss orders, and avoiding overtrading, key components of any successful micro futures trading plan.

Step 3: Plan Your Entry and Exit

A strong trading plan is essential when participating in volatile markets like bitcoin. Clearly define your entry and exit points, using technical analysis or strategy-based indicators to guide your decisions. The low tick value of micro bitcoin contracts allows for more gradual position sizing, making it easier to scale in or out of trades according to your risk profile.

Futures Contract Specs You Should Know

If you’re serious about trading bitcoin futures, knowing your contract specifications inside out is vital. Small details, from contract size to trading hours, directly impact how you manage risk and place trades.

Contract Size and Margin Requirements

Thanks to this manageable scale, traders can fine-tune their exposure, stacking or scaling out of positions in precise increments. Margin requirements are calculated by your broker or exchange based on current market volatility. Micro futures generally need much less margin than standard or mini futures contracts, which is ideal for smaller accounts and short-term trading strategies..

Trading Hours and Expiration

Most contracts are available nearly 24 hours a day, five days a week, but exact times depend on your chosen broker. Each contract comes with its own expiration date, which generally occurs monthly or quarterly depending on the product.

Be sure to watch for contract expiration dates and plan your trades accordingly to avoid surprises. Many brokers provide contract rollover features or notify you as expiration nears. To deepen your knowledge of how timing and contract rollover affect your positions, review dedicated trading resources on your preferred futures trading platform.

What Is a Tick in Futures Trading?

Ticks are the smallest measurable price change in futures markets. Each tick has a predefined value, which is critical to understanding both your potential profits and risks.

How to Calculate Micro Bitcoin Tick Value

That means each time the market moves one tick, your position gains or loses $0.50 (since the micro contract is one-tenth the size of the standard contract). By knowing the micro bitcoin tick value, you can always calculate the exact potential gain or loss for every price movement.

To plan your risk and set effective stop-losses, multiply the tick value by the number of ticks in your stop or take-profit range. For example, if your stop-loss is 10 ticks away, your total risk per contract is $5. This transparency is especially useful when trading with small accounts or experimenting with tighter risk controls.

Key Terms to Know for Trading Bitcoin Futures

A good grasp of key industry terms will give you an advantage in the world of micro futures trading. Here are a couple to know:

What is the Bitcoin Futures Symbol?

Every futures product has its own trading symbol, which you use to find and place trades in your broker’s platform. The CME Group symbol for micro bitcoin is MBT, while the standard contract symbol is BTC. Knowing the correct bitcoin futures symbol is important to avoid confusing products or accidentally placing too large a trade.

When researching, be sure to check your broker’s platform to verify the correct symbol before entering an order for micro crypto products.

What Are Mini Bitcoins?

Mini bitcoins refer to futures contracts with a size between standard and micro contracts. While not as common in crypto futures, they sometimes appear in other asset classes. Mini contracts are sized to offer a balance for those wanting less exposure than a full-size contract but more than a micro. Understanding how mini, micro, and nano products compare ensures you select the right tool for your trading objectives.

Conclusion: Trade Bitcoin Futures With Confidence

Beginners and experienced traders alike find tremendous value in the smaller contract size, allowing for precision, flexibility, and enhanced risk management. With a solid understanding of how micro bitcoin works, including tick value calculations, contract specifications, and platform selection, you can execute with more confidence and control.